Deferred compensation plan calculator

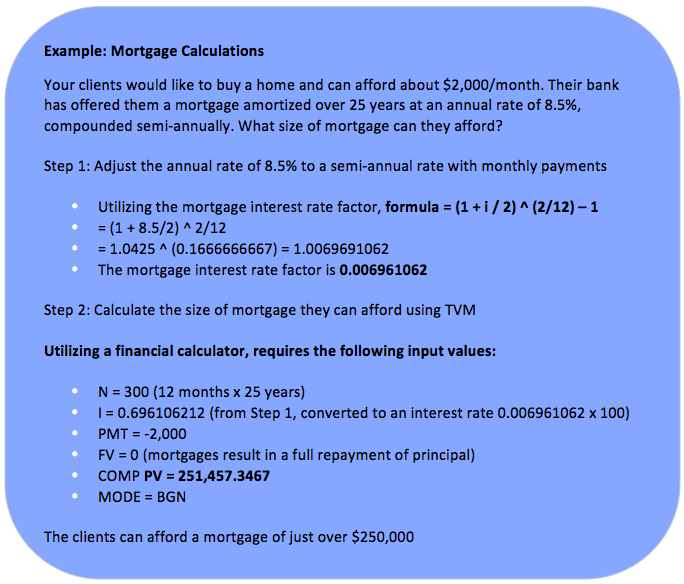

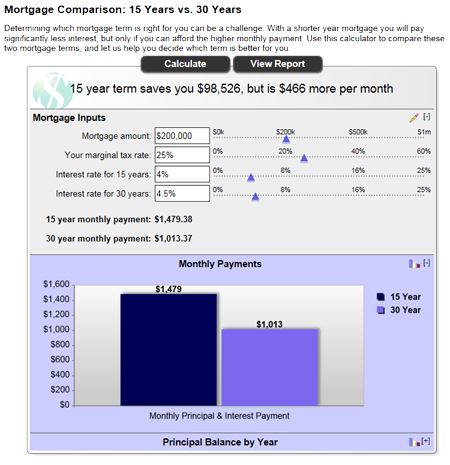

This calculator will estimate retirement benefits for all three options to help you better understand them. This calculator offers a financial comparison for Plans 2 and 3.

914 457 Images Stock Photos Vectors Shutterstock

Qualified Deferred Compensation Plans.

. Use this calculator to estimate the amount of money that would be withheld from your monthly pension payments for federal income tax based on. Unfortunately if you take a deferred retirement you lose access to your health insurance benefits FEHB. I calculated that I would lose at least 1000000 by retiring 1 day before my MRA.

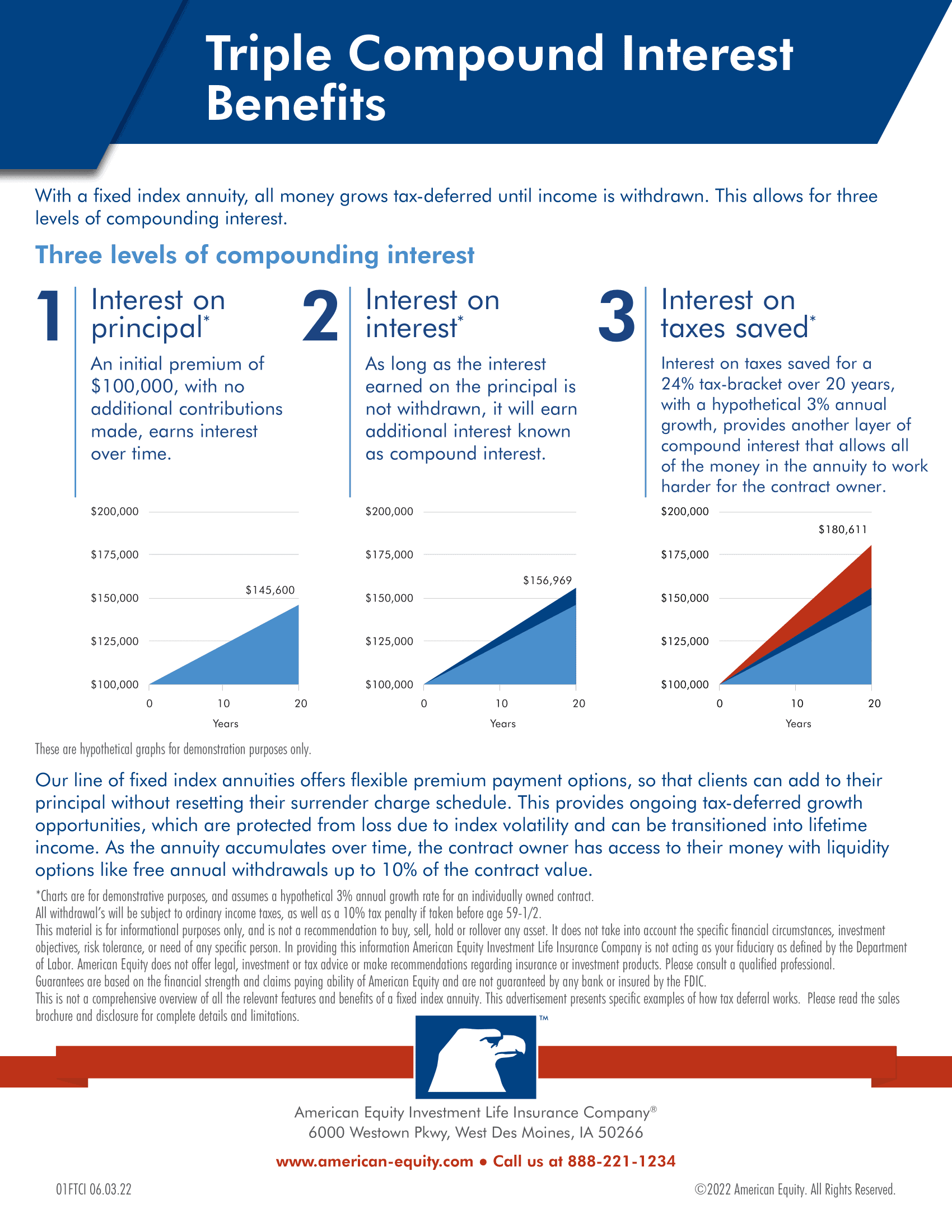

The State University of New York provides employees with the opportunity to save for their retirement through the SUNY 403b Plan and the NYS Deferred Compensation Plan. Tax-deferred growthSimilar to traditional IRAs or deferred annuities growth of investments with a 401k are tax-deferred which means earnings on interest dividends or capital gains. Employees may contribute as little as 15 per month or as much as 100 of their eligible compensation up to 20500 for 2022.

Are you a new PERS SERS or TRS member choosing a plan. As a supplement to other retirement benefits or savings that you may have this voluntary plan allows you to save and invest extra money for retirement tax-deferred. Eligible employees may participate in both the 457 Plan and the 401k Plan and can make pre-tax and Roth after-tax.

The Deferred Compensation Plan Congratulations on making a very important decision to start saving now for your retirement. About Your 457 Plan. Qualified deferred compensation plans are tax-deferred pension plans covered by the Employee Retirement Income Security Act of 1974.

457 Deferred Compensation Prudential Life Insurance Retirement Goal Calculator Online Account Setup Guide Social Security Pension Handbooks Pension Plan Overview PDF Air Guard Firefighter Handbook Firefighter Plan B Handbook Judicial Handbook Law Enforcement Handbook Public Employees Handbook Vol Fire EMT and SAR Handbook Warden Patrol. There are two different types of deferred compensation plans. The content on this page focuses only on governmental 457b retirement plans.

DCP is an IRC Section 457 plan administered by the Washington State Department of Retirement Systems DRS. Empower Retirement contracts with SERS to offer the deferred. DCP savings calculator DCP retirement planner Plan 3 members.

A deferred compensation plan is another name for a 457b retirement plan or 457 plan for short. The Maximum Loan Amount a participant may obtain is the lesser of. Inflation- the big downside of a deferred retirement.

The tax holiday represents a financial benefit to the company today but a liability to the. New Member Plan Comparison Calculator. Not only do you lose out on FEHB with a deferred retirement you also lose out on a FERS supplement.

Federal Income Tax Withholding Calculator. Every three years members voluntary contributions to their Hybrid 457 Deferred Compensation Plan accounts will automatically increase by 05 payroll deduction until reaching the maximum 4. Participating in a voluntary savings plan is a great way to build your retirement savings and allows for retirement savings on a pre- and post-tax basis.

Use this business valuation calculator to help you determine the value of a business. Outdated or Unsupported Browser. Deferred Compensation Plan.

A voluntary retirement savings plan that provides quality investment options investment educational programs and related services to help State and local public employees achieve their. Free 401K calculator to plan and estimate a 401K balance and payout amount in retirement or help with early withdrawals or maximizing employer match. Deferred compensation plans are designed for state and municipal workers as well as employees of some tax-exempt organizations.

457b plan offered by state or local governments and certain non-profits. A payroll tax holiday is a type of deferred tax liability that allows businesses to put off paying their payroll taxes until a later date. RSA-1 Deferred Compensation Plan.

For more details review the important information PDF opens in a new window associated with the acquisition. Heres how the 457b plan. Understanding Deferred Income Annuities.

If you participate in a deferred. Youre eligible for retirement benefits administrated by DRS. Typically you receive deferred compensation after retiring or leaving employment.

And one is riskier than the other. Written by Hersh Stern Updated Wednesday August 17 2022 A Deferred Income Annuity sometimes referred to as an Longevity Annuity or a DIA may be the right annuity for you if you are looking for payments that begin at a future date from two to thirty years from now and continue for the rest of your. There are also two catch up.

DEFER is the name of the voluntary retirement system 457b 403b and 401a savings plans available to most State of Delaware employees including employees of the Legislature Judicial and Higher Education Institutions. Therefore a participant should consider other ways to cover unexpected expenses. Types of Deferred Compensation Plans.

This code section has now become the de facto common name of a specific type of retirement plan. DCP is a great way to save. Tax-deferred and tax-free investment growth.

To encourage members to maximize their retirement savings the Hybrid Retirement Plan was designed with an auto-escalation feature. If you are a new SERS member you have 45 days to choose one of three retirement plan options. Deferred Compensation Plan DCP Overview.

RSA-1 is a powerful tool to help you reach your retirement dreams. Taking a loan from hisher Deferred Compensation Plan account can greatly impact ones future account balance. These tax-deferred saving plans allow employees to contribute by deferring compensation.

The New York State Deferred Compensation Plan is a State-sponsored employee benefit for State employees and employees of participating employers. Deferred compensation refers to money received in one year for work performed in a previous year often many years earlier. The Deferred Compensation Program has these calculators available.

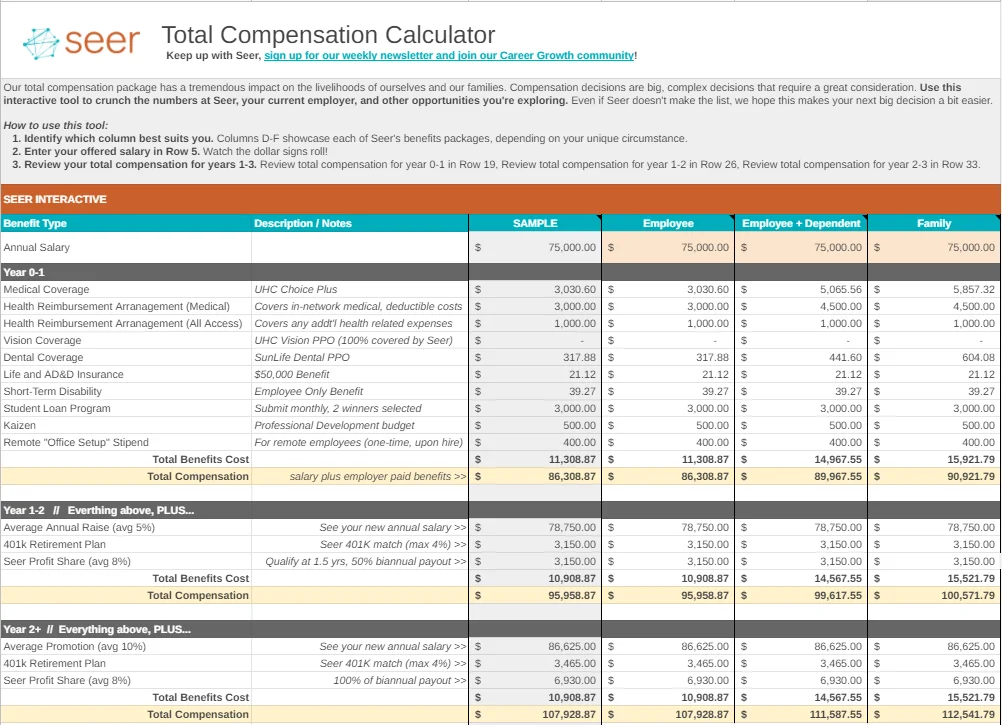

The minimum loan amount available from either the 457 or the 401k Plan is 2500. The Total Compensation Calculator is used to estimate the pay and benefits which make up the total compensation package for a given position. To determine the value of your business today based on discounted future cash flows with consideration to excess compensation paid to owners level of risk and possible adjustments for small size or lack.

Retirement and Financial Planners. You are using an outdated or unsupported browser that will prevent you from accessing and navigating all of the features of our. The 457b retirement plan offers many advantages to government workers including tax-deferred growth of their savings but these plans do come with some drawbacks.

Effective April 1 2022 Empower officially acquired the full-service retirement business of Prudential. Although tax-advantaged retirement plans such as 401k accounts are technically deferred compensation plans the term deferred compensation in. A deferred tax liability DTL is a tax payment that a company has listed on its balance sheet but does not have to be paid until a future tax filing.

Unlike traditional savings accounts DCP is tax-deferred it lowers your taxable income while you are working and it delays payments of income taxes on your investments until you withdraw your funds.

Looking For Secure Retirement A 457 Plan Could Be The Best Tool For Creating A Secure Retirement Use Our 457 Retirement P How To Plan Finance Blog Retirement

914 457 Images Stock Photos Vectors Shutterstock

457 Contribution Limits For 2022 Kiplinger

Time Value Of Money Tvm Calculations Plannerprep

Retirement Planner

Financial Calculators Service2client S Website Tools

Compound Interest Calculator Daily Monthly Quarterly Annual

Paycheck Calculator For Excel Paycheck Payroll Taxes Consumer Math

914 457 Images Stock Photos Vectors Shutterstock

Retirement Income Calculator Faq

Compound Interest Calculator Daily Monthly Quarterly Annual

457 Plan For Teachers The Enterprising Educator

Compensation Calculator Template Examples Seer Interactive

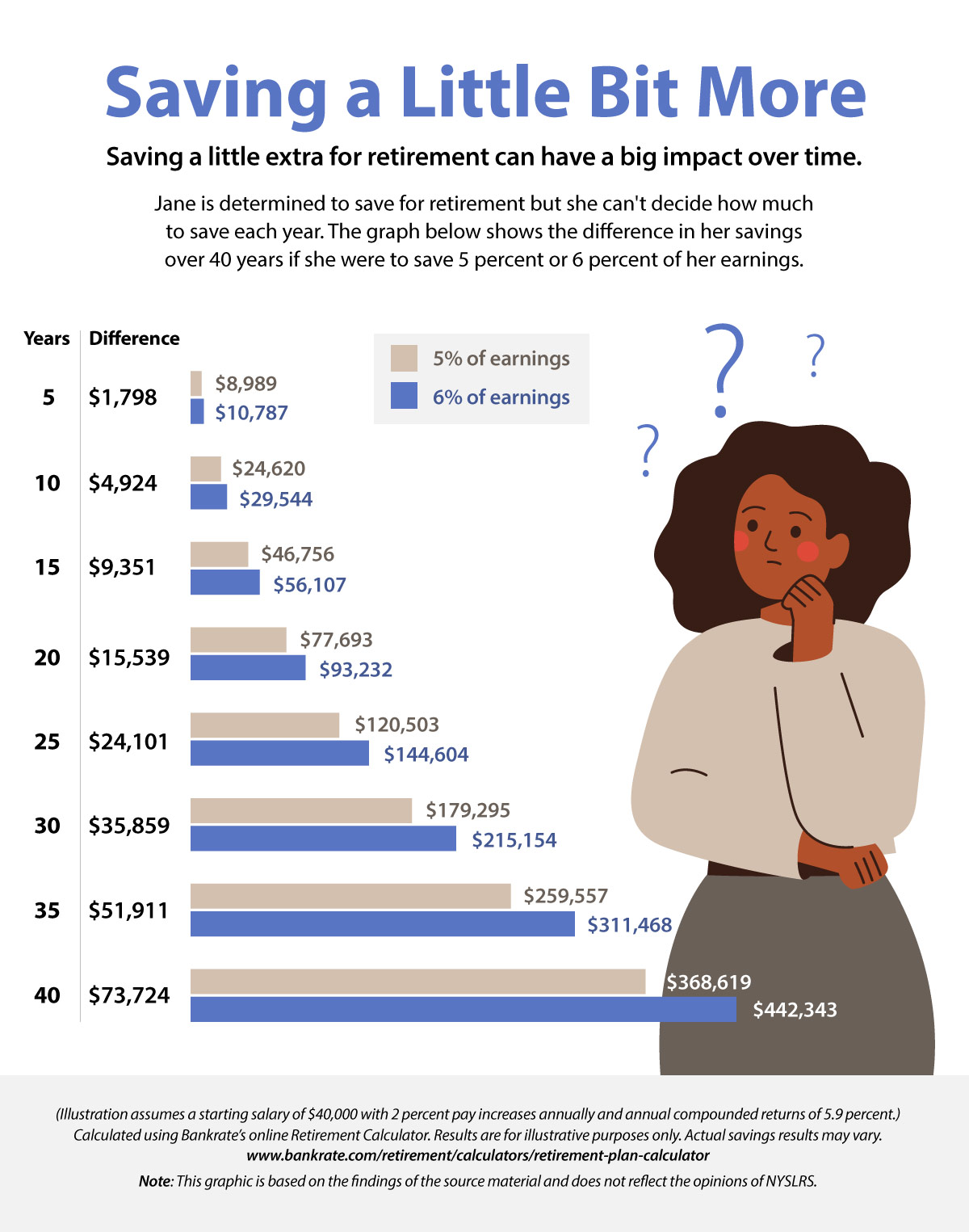

Give Your Retirement Savings A Boost New York Retirement News

Education And Tools San Diego County Office Of Education

How To Calculate Rmds Forbes Advisor

Retirement Calculator Sams Investment Strategies